Wohlfahrt eggs: Three generations of success

Consistency in applying the fundamentals of best business practice has kept Wohlfahrt Poultry Farm in business for three generations. This is especially important since the farm relies heavily on the human factor to get the job done.

By Kate Whittle

The two farms making up Wohlfahrt Poultry, located in the Gauteng region, have a capacity of 460,000 hens, including rearing houses for chicks. It averages a production rate of 90% between the age of 23 and 80 weeks and produces around 11.4 million eggs per month.

“It’s a family business”, says AJ Wohlfahrt, the farms sales and marketing manager. “Our business has the added competitive advantage of having the whole family involved in its operations. AJ’s sister Andrinet is the animal production manager while her husband Louis is the operations manager. AJ’s wife Louise runs the human resources department. Father Andre is the CEO of the company and his wife Bennette assists where she is needed.

Wohlfahrt Poultry Farm uses Amber-links, Lohmann and Hi-line hens. The laying hens in production amounts to 430,000. AJ says that by keeping all three breeds, they can do comparative testing on which breed performs better on what feed. The latter is also changed ad hoc according to which feed company provides the best feed at the best price.

They found that the Amberlinks do well on their farm as the breed performs well in their circumstances, taking into consideration the high density of poultry in the surrounding areas. Although the Amberlinks eat more, it is still more favourable taking their performance into consideration.

AJ admits that bio-security is a huge issue in their area because of the numerous chicken farms. The farm has numerous bio-security measures in place like a spray boom at the entrance, a shower in and out system, hand and foot dips in each house and access is restricted. “While we hear of disease challenges in our area our bio-security systems and the extensive vaccination programme worked out by our vet, has helped us to achieve higher production, better quality eggs and lower mortality rates,” says AJ.

The mortality rate among the layers is 0.10% while the industry norm is 0.12%. Wohlfahrt obtains day old chicks from suppliers which are then raised to 18 weeks, after which they go into production. AJ says that this is a competitive advantage of the business because having raised the hens themselves on the same farm as the layers, they know that the chicks are reared well and according to Wohlfahrt’s standards. The chicks also then have a chance to acclimatise to their farms, which helps to prevent post peak dips. But he notes that this can also be a disadvantage. “Keeping such young chicks on the farm is high risk due to their susceptibility to disease, but applying high bio-security standards limits this risk. So it still pays off as our mortality rate for the chicks is 1.2% to 2% whereas the industry norm is 3%.”

The pullets are kept in rearing houses with a flat deck system so that all the chicks can be viewed easily. Chicks aged one day to five weeks are kept in a small size house while those aged six to eighteen weeks are kept in a larger house. After eighteen weeks the pullets move into high-rise production houses with A-frame cages where they remain until they are 80 weeks old. At this age their production drops and they are culled.

To market

Culled hens are sold in the informal sector. Some 10% of the eggs are sold to the formal market, 75% to the informal market and the remaining 5% to wholesalers. AJ says that the latter market is used to sell excess eggs. Competition is high in the egg industry with large companies who have economies of scale to their advantage on the one side and small producers who are able to dominate an area on the other. AJ explains that both large and small businesses have a place in the market although the smaller businesses are more vulnerable during over production that leads to an oversupply in the market. Some bigger egg producers also have the added advantage of being part of feed companies. Considering that feed makes up 64% of the total cost to produce an egg, the ever increasing feed price weighs down heavily on farmers.

“This is why we use different suppliers and don’t limit ourselves to just one feed company. We compare prices, feed intake and the quality of the rations. Sometimes we pay more for feed which produces a better feed conversion ratio than cheaper food.”

Graphs are made up for each house so that AJ can monitor a specific breed of chicken on a specific diet, dependent on which feed company performs better at a specific time. The next flock placed in the laying houses will receive their feed.

The Wohlfahrt’s did at one point mix their own feed to save costs but found that the practice was too specialised for their size business. “If there is a problem with the feed we can hold the supplier responsible. But if we mix it ourselves the respoinsiblity rests on us, which increases our risk.”

AJ says that profit margins on the farm took a dip in the last year due to an oversupply of eggs on the market, caused by farms that expanded more than the demand. Fewer diseases which normally restrict production also added to the higher supply of eggs. “Currently we supply eggs at the same selling price as in 2009.”

The eggs are graded and packed on the farm but plans are underway to have the pack station moved to another location. “From a bio-security point of view we want to limit the amount of people coming onto the farm. Furthermore if our farm were to be suddenly quarantined we wouldn’t be able to move any eggs to and from the existing pack station.”

Wohlfahrt’s growth over the years has also necessitated the expansion of the pack stations. “The pack station as it is now was built to handle only a third of our current capacity. The equipment also needs to be replaced because of inefficiency and the restrain of capacity,” AJ explains. The pack stations make use of two Moba 2000 and a Moba 9 grading machine to sort and pack the eggs. AJ says that once they have moved to the new premises the three machines will be replaced with one grading machine that has a higher capacity.

Urban mind set

AJ notes that setting up the new premises with the packing station is being delayed due to the approval from government.

The Kromdraai area where Wohlfahrt is based is situated in the Cradle of Humankind, which is a Word Heritage site. This restricts growth on the current premises for the future. Increasing residential developments are sprouting up around the farm. This creates its own problems as the new neighbours are less keen on staying next to a poultry farm. The municipality does regular inspections on the farms to ensure that they comply with all the regulations that come with farming in what is increasingly a residential area.

With large amounts of chicken manure at their disposal, biogas production would have been an ideal side-line activity on the farm and would help reduce electricity costs. “But heaping up manure outside of the chicken houses is out of the question because of our location, so we had to shelve our biogas plans,” says AJ. As some South African consumers become more aware of environmental and animal welfare issues so too is demand for free range and organic eggs growing. “The upper classes are more worried about getting free range eggs. But South Africa for the most part is a third world country so interest in environmental issues is low among the masses as they are more concerned about price. So there’s little consumer pressure to change farming practices.”

The human element

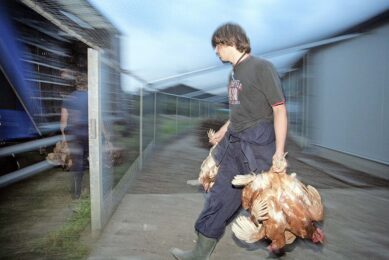

Wohlfahrt relies strongly on manual labour on the farm to do the bulk of the work. “Unemployment in South Africa is ever increasing and we are of the opinion that all the businesses are responsible in helping create jobs,” says AJ. All the eggs on the farm are hand collected and one worker is assigned to one of the 46 houses to collect the eggs, clean the houses and look after the 10,000 hens in each house. AJ explains that managing their own chicken house creates pride among employees. “If we had to install a mechanical egg collector system it would take us nine years to pay it off with the money we would save on labour so it has never been worth the expense.”

In a country marred by labour protests and often violent strikes, Wohlfahrt is fortunate in that they have evaded any labour unrest on the farm. “We have an open door policy with our staff and they can approach a manager at any time if they have a problem. We also place a strong focus on teaching our staff problem solving and people skills.” AJ says that Wohlfahrt’s labour force really is a competitive advantage on the farm because everyone has a great attitude. “Our staff turnover is low so we also save on training costs.”

Strikes in parts of South Africa earlier this year led to the minimum wage paid to farm workers nearly doubling. This has placed enormous strain on farmers, many of whom have drastically reduced their labour force. “This did not affect Wohlfahrt Poultry because we already pay our workers more than the current minimum wage.”

Politics halts growth

For many farmers South African politics is one of the biggest threats facing their businesses. With regular warnings of land grabs many fear that the country will go the same route as Zimbabwe, where the agricultural sector has been brought to its knees by illegal land occupiers endorsed by the government. Although the South African government has for the most part denied that land grabs would be allowed, they have been pushing hard to complete the land reform programme that has a target of placing 30% of farms in black hands. This has made many farmers nervous about investing in expansion. AJ explains that they fear that their farms might be taken without proper compensation.

“This is a sad situation because the farmers who supply South Africa with their much needed food are neglected and the sword of uncertainty created by the government adds to this uncertainty. This then restricts expansions and much needed job creation.”

According to AJ, Wohlfahrt’s sustainable competitive advantage lies in the fact that they are self-sufficient in rearing, production, grading and the marketing of their own product. “But due to the uncertainty of the future, we might be forced to make use of contract producers that will supply us with eggs instead of expanding our layer capacity. This might reduce the sustainable competitive advantage. “Although there are many challenges in poultry farming we as the Wohlfahrt family hope and believe that we can produce and distribute a quality, cost effective product that we can be proud of.”

Join 31,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the poultry sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht