Inghams settles in as a publicly listed company

In early November 2016, Inghams, Australia’s largest and best known broiler chicken meat producer, listed on the Australian Stock Exchange. Good demand, low feed prices and operational measures helped their bottom line.

Not since 1999 has there been a major publicly listed company supplying chicken meat in Australia. In March of that year the SE Asian/Oceania based food producer, Goodman Fielder sold its Steggles chicken meat business to Bartters which was, like Inghams, a privately owned company.

Inghams, which today holds around 40% of the market for poultry meat in Australia, was established in 1918 when Walter Ingham (Snr) acquired 6 hens and a rooster for his son, also named Walter Ingham. The business grew steadily until the 50s when it took off in the hands of Bob and Jack Ingham, sons of Walter (Jnr). A number of factors helped to drive the growth of Inghams Enterprises. The decade after WW2 saw a major population expansion in Australia through migration, mostly from Europe and then the first supermarket chain, Woolworths, started opening its stores in major population centres. Inghams formed a special relationship with Woolies who realised the potential of affordable chicken to drive consumers to its stores.

Adapting traditional skills

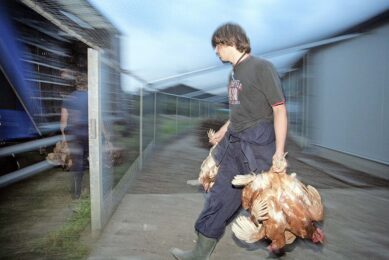

Though Inghams may not have been alone in using a network of contract growers to supply birds to its processing plants in Australia, having seen the success of the idea in the US, they adopted this strategy with both speed and entrepreneurial skill. Families, particularly from southern Europe, were quick to adapt their traditional agricultural skills to poultry farming in Australia, and broiler farms were soon established on the outer fringes of first Sydney, then progressively throughout the country.

Jack Ingham passed away in 2003 and Bob Ingham continued to operate the company until 2013 when he decided to sell it. Speculation in the financial press in both Australia and internationally, was that Inghams was worth around the AUS$ 1 billion mark. In the end the Texas Pacific Group (TPG), a private equity group based in California with over $ 75 billion in reserves, was the successful party with an offer of $ 880 million.

Sold to private equity

After taking over Inghams in March 2013, TPG continued to operate the company with existing senior management in place. TPG sold much of its infrastructure to property investment trusts and has leased it back on long term contracts. This strategy was reported to have generated more than $ 550 million. Much of this sum has subsequently been invested in new facilities, mostly in South Australia and Queensland.

Despite the highly competitive nature of the Australian retail market with the once dominant Woolies battling first Coles (now a subsidiary of the multi billion dollar Wesfarmers conglomerate) and then Aldi, which is rapidly expanding both the number of stores (from 373 to 628) and its product range, TPG/Inghams had a couple of good years before the decision to float on the ASX. Inghams is an established supplier to the growing Aldi store network. According to recent media reports on the growth of Aldi, “the relationship basis with Aldi’s suppliers fundamentally differs from those held in recent times by the Coles/Woolies duopoly”, industry analysts commented. Whereas the relationship with Coles/Woolies is viewed by industry observers, “as being ‘master/servant’ in nature, Aldi works closely with suppliers to respond both to consumers and the need for both parties to be profitable”. The retail space in Australia may get even more crowded with the possibility that Lidl and Amazon will set up in Australia by 2020.

Currently around 40% of Inghams revenue stream comes from sales to the big retail players. A more diverse and competitive retail landscape could be seen as a benefit in the future for suppliers of chicken meat . The quick service restaurant (QSR) sector is also strong in Australia and New Zealand with chicken based meals being a key driver of QSR volumes. Inghams achieves around 17% of its revenue from this source.

Though some commentators in the Australian banking sector were pessimistic about the continued rise in the popularity of chicken meat over other protein sources, and in particular red meat, the Australian Bureau of Agriculture, Resources Economics and Sciences Research (ABARES) has a different view. In its ‘Chicken Meat Outlook to 2021-22 by Tim Whitnall’ the prediction was for continued growth.

Publicly listed

When TPG floated just over 50% of its interest in Inghams on 7 November 2016 at $ 3.15 a share it raised just over $ 440 million. Retaining 47% of the equity was probably a wise tactic as Australian investors had become wary of private equity IPOs after a few spectacular failures in recent times. The profit predictions for the near future are based on TPG’/Inghams ‘Project Advance’ strategy to cut between $ 160-200 million out of operating costs.

2 years into the 5 year strategy there is a new management team installed at Inghams. The new CEO Mick McMahon, had a senior role at Coles, the big retailer that has arguably been the greatest cause of change to retailing in Australia during recent times. The critical role of Technical Services Manager at Inghams was given to Dr Elizabeth Krushinski in early 2016. Dr Krushinski, with long experience in the US poultry industry, gained her PhD in the study of Avian Influenza and is a board certified poultry veterinarian through the American College of Poultry veterinarians. Dr Krushinski spoke at the AMC/PIX 2016 conference (the leading poultry industry trade exhibition and conference held every 2 years in Australia) on the US experience in dealing with AI.

Philip Wilkinson, OAM, was a driving force behind the successful UK ‘Red Tractor’ branding scheme for livestock products. He was also Managing Director of the major UK broiler producer, 2 Sisters and is now a senior advisor to Inghams. It is very possible that in his role while managing broiler production over a prolonged period in the UK, he would have been in negotiations with some of today’s managers of retail operations that have worked in the ultra competitive UK retail sector.

Today Inghams employs more than 8000 people in its Australian and NZ operations. The network of mostly contracted broiler farms numbers 188 in Australia and 37 on the North Island of New Zealand. There are eight feed mills (with one more under construction as part of the company’s expansion plans in South Australia), 74 breeding farms (14 in NZ), 11 hatcheries (one in NZ), seven primary processing plants (one in NZ), seven further processing (one in NZ) and nine distribution centres (two in NZ). There is also a quarantine facility in Australia and a rendering plant which supplies its pet food operations.

Expanding operations

Speaking on the Australian ABC Rural radio network, Ingham’s CEO Mick McMahon stated that Inghams was considerably expanding its operations in both South Australia and Queensland, including new hatchery and breeder facilities in South Australia. “We have invested more than $ 275 million in our South Australian operations,” he said. “All our broilers are now grown according to RSPCA (Australia) protocols,” he added. The Australian RSPCA broiler chicken accreditation scheme now covers about 80% of all broiler production in Australia. Key elements of these protocols include lower stocking densities than would other wise apply, based on existing regulations which are determined by each Australian state. Other RSPCA requirements are for deeper litter, perches and specific phased lighting periods.

Around 11% of Inghams broiler production is from free range farms and there are a number of new sheds that have been built in the Murray Bridge area in South Australia where there is a lot of available land allowing for good separation between livestock operations which are today, dominated by pig and poultry production.

When announcing financial results for Inghams Group Limited half year ending 24 December 2016, the company reported that, “poultry volumes were up at 248kt, increased by 12.9% revenue up 4.3% and net profit after tax ($ 51.3) up 13.8 %. Key highlights identified in the report were that “first half performance was in line with prospectus performance and that there was strong volume growth driven primarily by both retail and QSR customers. “Results were delivered despite challenging New Zealand market conditions, created by oversupply in the domestic market. This situation was caused by a fall in export markets translating to domestic oversupply,” the report stated.

“The critical ‘Project Accelerate’ initiatives are delivering as expected and the first phase automation projects operational in primary processing plants and the closure of the Cardiff plant in New South Wales complete with production transferred to other locations. “There is good progress on labour efficiency improvement, procurement and other initiatives. Further investment in capability, marketing and new product development resources has been achieved,” the report stated.

Increase in meat production

One of the key factors in the sustained rise of chicken meat production in Australia in particular is perversely, stagnant wage growth. The Australian and New Zealand economies have maintained a prolonged period of growth and unemployement levels that are the envy of other developed economies and real wages have hardly risen at all in the last 5 years. Housing costs, particularly in major cities like Melbourne, Sydney and Auckland in New Zealand have risen dramatically, as have both household and industry energy bills.

This means that food costs are critical to consumers and the low cost of chicken meat when compared to other protein sources, is without doubt continuing to drive up consumption. Further it seems obvious that the ‘millennial generation’ really like chicken, either to cook themselves, or increasingly through QSR and food service in general.

To add to a good scenario for the entire poultry sector in Australia, feed costs have fallen dramatically over the last 2 years, which with other operational initiatives, has really helped Ingham’s bottom line.

Join 31,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the poultry sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht