Assessing global trends in bacterial enteritis

![Diarrhoea and wet litter continue to be the signs most often associated with emerging cases of BE. [Photo: World Poultry]](https://www.poultryworld.net/app/uploads/2021/04/001_771_rb-image-2719398-848x565.jpeg)

Elanco Animal Health recently released findings from its fourth Bacterial Enteritis Global Impact Assessment (BEGIA), providing interesting insights into ongoing trends of a disease that continues to have important impact on our industry.

Elanco has conducted this survey every five years since 2000, surveying poultry professionals from the major poultry-producing regions around the world. The 15 years of survey data shows that prevalence and economic loss continue, while early intervention becomes a more favoured strategy as the years progress.

The 2015 survey included over 330 respondents comprising veterinarians, producers/production managers, nutritionists, on-farm managers and other industry professionals from 38 countries. Participants were asked a series of 25 questions, including several questions repeated from past surveys, to assess prevalence, treatment, impact and attitudes about bacterial enteritis (BE).

This year’s results confirm those from past surveys: BE continues to be very prevalent and affect productivity and profitability. However, the 2015 survey also found some interesting new trends in treatment initiation, perhaps as a way to mitigate these effects.

Clostridial/necrotic enteritis was seen most often (52.5 %), but Dysbacteriosis was nearly as common, at 51.9 %.

Prevalence

Nearly 75% of respondents reported diagnosing BE in their flocks at some time, and 78% said they were currently experiencing one of the three forms of BE at the time of the survey (Figure 1). Clostridial/necrotic enteritis and dysbacteriosis were reported overall at very similar rates (52.5% and 51.9% respectively), with cholangiohepatitis reported at low rates, except in North Africa/Middle East countries (NAMA), where it accounted for more than a quarter of cases respondents had seen. Almost two-thirds (64%) of respondents feel the BE problem will remain the same or get worse over the next five years (Figure 2).

BE continues to be a big concern, with a majority of respondents (64.1%) believing the issue of BE is the same or worse than it was in 2010.

Signs and diagnosis

Diarrhoea and wet litter continue to be the signs most often associated with emerging cases of BE (as found in 2005 and 2010), and necropsy and clinical observation are still the preferred methods for diagnosing BE. High percentages of respondents associate coccidiosis with increased prevalence and severity of BE (Figure 3). Most respondents agree that preventing coccidiosis reduces issues at processing (Figure 4).

The vast majority of respondents agree that BE prevalence and severity increase when coccidiosis is present. NAMA participants agreed 100% with this statement.

Over half of the respondents agree that preventing coccidiosis results in several benefits at processing, including fewer condemnations, better plant efficiency and reduced gut breakage.

BE still impacting profitability

As in past years’ surveys, respondents in 2015 indicated BE can significantly impact their profitability. Those surveyed identified disease, feed optimisation and missed target weight as the most important factors influencing operational profitability, and these are of course problems also directly related to BE. Over 90% of the respondents reported at least some performance loss caused by BE, with worsening feed conversion and weight gain being the most frequently cited issues (Figure 5).

The effects of BE align directly with the economic concerns. 91% of respondents report some performance loss caused by BE. Impaired FCR and reduced weight gain continue to be leading issues.

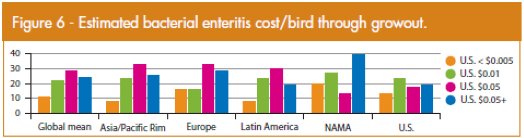

Over half of respondents estimated per-bird costs of BE at more than US $0.05, or $50,000 for every 1 million birds affected. North Africa/Middle East countries in particular associated BE with higher costs (Figure 6).

Over half of repsondents (52.5%) estimated the cost of BE per bird at US $0.05 or higher. This equates to $50,000 for every million birds.

Treatment initiation trends earlier

As in past surveys, respondents were asked to look at photos of intestinal lesions and assess at what stage of illness they believe economic damage was likely to occur. About half of respondents said they believe economic losses begin at the earliest stage, an increase of nearly 5% compared to 2010 (Figure 7). More telling perhaps is that 45% of participants would also initiate treatment at this earliest stage (Figure 7).

The gap between when respondents say economic loss begins and when they begin treatment is narrowing. In 2010, the gap between economic loss versus starting treatment in Stage 1 was 12%, now it is only 5%.

This 5% gap between perceived economic loss and initiating treatment is less than half that seen in 2010 (12%). This indicates that industry professionals are more closely associating sub-clinical disease with economic loss, and are more willing to start treatment sooner to offset potential harm to their profitability.

Survey participants also seem to be trending toward earlier flock treatment, with most indicating they would initiate treatment when 5-20% of the flock is infected (Figure 8). In 2010, respondents favoured treatment when 20-30% of the flock was infected.

Opinions on when to treat the entire flock varied widely in the 2015 survey, but indicated a strategy of treatment before the flock is widely infected. The largest percentages clustered around 5-20%.

Treatment options remain the same

More than 75% of the survey participants indicated that their end-customers (retailers, slaughterhouses, exporters, etc.) preferred a preventive approach to managing disease. When it comes to preventing BE, respondents find water treatment and growth-promoting feed additives the most effective options, a trend that hasn’t changed since 2010 (Figure 9).

Almost one-third of respondents rated water treatment as the most effective option for preventing BE, with vaccines ranked the lowest in efficacy. This mirrors the preference rankings from 2010.

15 years after it was initiated, the BEGIA survey continues to provide valuable data on industry trends, disease prevalence and effects of bacterial enteritis.

While the disease is still both prevalent and costly, poultry professionals around the world seem to be recognising the benefits of earlier treatment. The fact that respondents’ preferences for the same diagnostic and treatment methods remain unchanged year after year hints at possible opportunities for better productivity and profitability if easier diagnostics and more prevention options became available.

BE clearly continues to be a widespread, complex issue. If more improvements are made in prevention, diagnosis and treatment, producers will have a better chance to achieve and maintain Intestinal Integrity in their flocks and perhaps we will see even more positive changes in BE trends come 2020.

Join 31,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the poultry sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht