Kiotech Int: Sales up threefold and profits up 157%

Kiotech International, the international supplier of natural high performance feed additives to enhance growth, health and sustainability in agriculture and aquaculture, has announced its interim results for the 6 months to 30 June 2010.

Key points: Financial

• Optivite, acquired in September 2009, makes a full six months contribution.

• 157% increase in profit before tax to £0.777m (2009: £0.302m).

• Threefold advance in sales to £11.082m (2009: £3.468m).

• Cash balance of £4.554m at 30 June 2010.

Key points: Operational

• Integration of Optivite progressing well with consolidation of our operations starting to deliver the planned benefits.

• Good performance from our international agriculture division.

• Contracts exchanged to acquire the Manton Wood production and head office site for £1.450m.

• Aquatice® given approval to market for both fin fish and shrimp in the Philippines.

Chief executive Richard Edwards, chief executive, commented:

“We are encouraged by our trading performance to date and remain confident going forward given the good progress in integrating the Optivite acquisition. Management remains focused on consolidating our operations into a single unit to deliver the planned benefits, whilst retaining and promoting separate brands in the marketplace.”

Operations – Agriculture

Agil continued to make progress during the period with some particularly strong performances from Argentina, Bangladesh, Malaysia, Peru and Poland. In Malaysia we successfully launched a new mycotoxin binder product, called Neutox, which in addition to removing harmful mycotoxins in the animal feed also prevents future mould growth and consequently new toxin development. The success of this value-add product has encouraged us to market it in other territories around the world.

A number of strong performers last year have struggled to maintain their momentum in the first six months of this year for differing reasons. Chile’s poultry integrators have been affected by the earthquake earlier this year, and Vietnam’s aquaculture industry, into which we sold significant volumes of our pellet binder, Aquacube®, suffered a poor market towards the end of 2009. It is a feature of the business that being geographically diverse means short-term poor performance in a territory can be offset by strength elsewhere in the world.

We now have four acidifier products registered in Brazil, where our distributor is focusing on marketing Salkil to some of the world’s largest poultry integrators, where feed volumes are significant. In China, we now have a number of products registered, for which we have embryonic sales. Again, our Chinese sales team is focusing on some of the larger meat producers where the volumes are significant but the selling process can be lengthy and sometimes complex.

Vitrition, our organic feed brand, which operates from one of only two dedicated organic feed mills in the UK, and accounts for around 17% of Group turnover, has been focused on improving margins in the business.

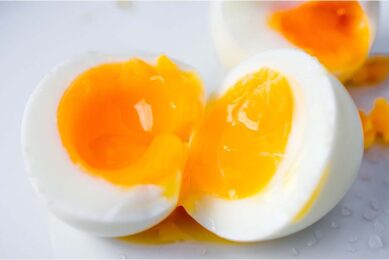

The Optivite acquisition brought a range of more nutritionally based products to our portfolio, which complements Agil’s strength in products for biosecurity applications. The Agil sales team has started to market a number of these new products such as the omega-3 supplements, which Optivite developed and leads the market. These supplements enhance fertility, viability of young animals, growth rate and also increase the omega-3 content of meat and eggs for human consumption. Human health is an important consideration in household purchasing decisions around the world; especially as developing nations move towards a more meat protein based diet.

Join 31,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the poultry sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht