Maghreb countries invest in poultry production

Tunisia and Morocco are two of the most important poultry production countries in Africa’s Maghgreb region. Both invest in securing food supply, and both enjoy healthy growth in production. Tunisia operates under a stringent production control programme, whereas Morocco enjoys a free market policy with a desire to export.

By Philippe Caldier

Tunisia, located in the north-eastern part of Africa’s Maghreb region, is a small country, but with a rather high standard of living for its 10.2 million inhabitants. In 2008, the gross per capita income was US$7,900 and the growth of the economy 4.7%. Agriculture still accounts for 10.8% of the country’s gross national product.

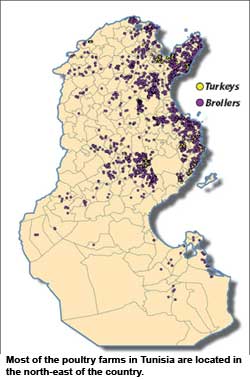

Poultry is one of the most important livestock sectors in the country. “Our sector is characterised by a steady annual growth of 4.3% for poultry meat and 1.3% for egg production,” says Dr Riadh Karma, who is the General Director of GIPAC, the Interprofessional Association for Poultry and Rabbit Products. The poultry industry is primarily located in the east, particularly by the coastline of the country. During the past 10 years, poultry production jumped from 36% to 50% of the total meat produced in Tunisia (see Table 1). For 2009, production is forecasted to be are around 140,500 t, of which 88,000 t is broiler meat and 40,000 t is turkey meat.

The egg sector enjoys a similar trend and saw an increase in production to around 1,6 billion units in 2008 (Table 2). These eggs are supplied by 300 average-sized farms with and average capacity of 30,000 laying hens. Most of these farms are located in the north-east and the east of the country.

Guaranteeing a steady supply

One of the peculiarities of Tunisia’s poultry production is that it is programmed on the basis of production and consumption figures during the year. CIPAC collects these figures twice a month, forecasts the needs, and sets import quotas for hatcheries. “To limit over-production and to prevent shortages we usually keep 1,500 t of poultry meat and 1,500 t of turkey meat in our freezers,” explains Dr Karma. This meat storage policy proves to be very useful during the summer months when some 6.5 million tourists visit the country. A similar programme is in force for the egg industry. “Our goal is to store 80 million eggs by the end of July to balance the additional needs from tourists and local consumers during Ramadan. This usually means that we already store 40 million eggs by mid-May,” says Dr Karma.

One of CIPA’s main concerns is food safety and quality. While the production capacity is smoothly growing year by year, more attention has to be given to logistics as well as to the industry’s infrastructure. During recent years the number of chickens sold alive on wet markets dropped from 72 to 40%, but it is CIPA’s goal to slaughter 95% of all poultry in slaughterhouses by the end of 2010, says Dr Karma. This means that more slaughterhouses should be built near the production locations. Today, the country has 21 slaughterhouses in operation and 4 that are under construction. Some 95 egg producers have already refrigerated storage to secure egg freshness and quality.

“It is not easy to change the mentality of our farmers or the consumers,” admits Dr Karma, “We already equipped 2,500 selling points with refrigerators and will have to tell consumers about the investments made by all partners in the food chain to secure the quality of the final product.”

Morocco’s confidence results in investments

Morocco is in the most north-western part of Africa and is considered to be the second largest economy (after Algeria) in the Magreb region. Its gross domestic product is US$137.3 billion, or about US$4,000 per capita. The forecast economic growth of 5.9% is currently the best in the region. Consequently, the forecasts for the poultry industry are looking positive too. Poultry meat accounts for 52% of total meat consumption, and the increase in production has been impressive. Between 2002 and 2008 the production of turkey meat jumped from 10,500 t to 50,000 t (+476%) while that for broiler meat increased by 56% from 200,000 to 330,000 t (Table 3). Poultry meat consumption also significantly increased by 44% in the same period. Production of almost 400,000 t of poultry meat and 2.9 billion eggs Morocco covers more or less 100% of its needs.

Statistics published by FISA (the interprofessional poultry federation of Morocco) show that the turnover of Morocco’s poultry sector is about €1,5 billion per year, providing 84,000 permanent jobs and around 200,000 indirect jobs in the various production, marketing and distribution branches of the industry.

One billion dirham credits

Poultry is one of the most dynamic agricultural sectors in Morocco. The industry’s infrastructure includes 40 feed plants (producing 2.2 million t feed per year), 40 hatcheries to produce broiler chicks, 4 hatcheries to produce laying hen chicks, 3,616 registered broilers farms, 254 registered turkey farms, 197 laying hens farms, and 23 registered industrial slaughterhouses. Chaouki Jerrari, Director of the Poultry Federation of Morocco “FISA” (Fédération Interprofessionnelle du Secteur Avicole) expects to see a small drop of 3-4% in broiler production in 2009, and an increase in turkey production from 5-10%. For the egg industry he expects no real changes in production volume.

Jerrari explained that Moroccan poultry production is controlled by means of a contract-programme signed on 20 April 2007 between FISA and the State. “This contract programme considers poultry production to be strategic for food supply in Morocco,” he says. The deal with the government allowed the industry to get some new credits called Dawajine. These credits began in 2009 to help farmers build new poultry units or to buy equipment. Meanwhile, one billion Moroccan dirhams (about €89 million) has been agreed by Crédit Agricole du Maroc (CAM) at a maximum interest of 6% without taxes, of which 3% is taken into account by the State.

Production authorisation required

A concern of FISA is how poultry farms receive an official authorisation to work. In 2007/2008, the government introduced this authorisation system in order to force poultry farmers to follow improved technical and zootechnical standards. At present, some 80% of all broiler farms, 99% of the turkey farms and 90-95% of all egg producers have received authorisation.

“As a consequence of the authorisation process, farmers had to make considerable investments. Now, some new broiler units (mostly integrated with big hatchery groups) have a capacity of 100,000 – 200,000 broilers. The turkey sector enjoyed new projects as well as extensions of existing units with an average of 3,000 – 40,000 turkeys per farm,” said Jerrari.

The high increase in the cost of feed due to the import of most of the needed raw materials is another concern for the Moroccan poultry sector. As the selling price for their end product did not increase at the same level, the most fragile farms were forced to close. “We operate in a complete free market and our prices are very volatile,” the FISA Director complains. “Take for example the broiler price. Recently the farm gate price dropped in one month from 15-16 dirham per kg [€1.30] to 12 dirham [€1], which hardly covers the costs.”

Nevertheless, Jerrari states that Morocco wants to become an exporter of poultry products. “During the beginning of 2009 we began exporting chicks, poultry feed and hatching eggs to Mali and Mauritania. We also have the will to become a major exporter to Europe, but before we can do so we need to meet the EU standards and receive an EU permit,” says Jerrari.

SIPSA 2009: Inzo and Safana sign partnership During the last SIPSA international exhibition of livestock, which took place in Algiers, Algeria, from 12 – 15 May, the French company Inzo and the Algerian premix producer Safana signed an agreement for cooperation and partnership. Inzo Export Manager Augustin Michel stated that is was a good time to develop their presence in Algeria as its feed market and integrated livestock production show good progression. Since 2005, Safana owns a premix plant in Sétif in the north-east of the country. Inzo will sell highly concentrated premixes to Safana that are diluted by Safana so it can be sold to feed producers, distributors and farmers. |

Join 31,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the poultry sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht