Labour shortages threaten growth of Eastern Europe’s poultry sector

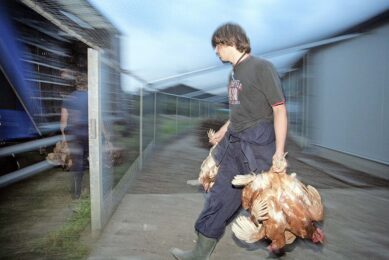

Poultry producers in Eastern Europe are confronted with a fully-fledged labour crisis, caused by the bustling post-pandemic recruitment frenzy, coupled with long-standing demographic issues. Worker shortages threaten to slow production growth and make some of the largest European poultry producers less competitive due to higher costs.

The Russian poultry industry is short of 6,000 workers, the Russian Agricultural Ministry reported late 2020, citing an estimate provided by Russian poultry farmers’ organisations. During a meeting, the Ministry specifically confirmed a worrying shortage of personnel in the production facilities of the largest companies, Cherkizovo and GAP Resource.

The current situation could cut a range of poultry products normally available on the Russian grocery shelves

GAP Resource said on its own behalf that the problem is associated with a gradual exodus of the Russian population from small cities, where most of the Russian industrial poultry farms are based, to large metropolises. Cherkizovo added that the booming e-commerce industry was luring some workers away from poultry farms because the migrant workers they normally relied upon couldn’t travel due to the Covid-19 pandemic. “The current situation could cut a range of poultry products normally available on the Russian grocery shelves, while under a negative scenario it could cause a decline in output altogether,” GAP Resource warned.

Efforts made to attract momre migrants

Sergey Lakhtyukhov, general director of the Russian Union of Poultry Farmers, commented that the labour crisis in Russian poultry farming reached a peak at the end of the summer of 2021. “Today, slaughterhouses and processing facilities especially, have workforce issues. The farming sector has been affected by this issue to a lesser extent,” said Lakhtyukhov, adding that some measures have been implemented by the Russian Agricultural Ministry to attract more migrants from within the CIS region.

Competitive labour market

“The expanding e-commerce segment, where salaries are sky high, was drawing workers away from the poultry sector,” Lakhtyukhov noted, adding that this problem is seen in Russia and beyond. The picture is similar in Poland, Europe’s largest poultry exporter. Krzysztof Hajłasz, an expert for the Polish Export Centre, said that in addition to travel restrictions, quarantine and distancing mandates, labour costs had jumped due to general inflation. “This has the greatest impact on blue-collar workers and drives them to seek higher salaries. Luckily, smaller companies often employ mostly family members. They are less likely to leave a family business, so these operations are less impacted by the migration to higher wage jobs. Large-scale production and slaughterhouses are experiencing the greatest impact, as a significant percentage of their workforce comprises non-EU citizens – mostly Ukrainians,” Hajłasz said.

Restrictions due to covid

The distancing requirements and quarantine measures imposed to prevent the spread of Covid-19 have driven up labour costs, as well as increasing the competition for workers which is getting fiercer. Anatoly Nasenya, a member of the Belarusian National Assembly, said that the country was experiencing a labour shortage, as the number of vacancies in 2021 rose to 74,000, while the unemployment rate hit a record low of 0.2% of the working-age population. Nasenya added that Belarusian farmers are finding it hard to recruit workers which, in his opinion, could be met by attracting foreigners.

Anna Sergienko, marketing manager of Poultry Ukraine, is less downbeat. She stated that she was not aware of any Ukrainian poultry company with a shortage of workers. However, Ukraine is at the forefront in terms of migration in Eastern Europe. In the first 10 months of 2021, 600,000 Ukrainians left the country – the highest figure ever, the State Statistical Service estimated. Between 2010 and 2020, as many as 2.6 million citizens moved out of the country, constituting nearly 10% of the country’s overall workforce.

Changing labour conditions

Galina Bobyleva, chairperson of the Russian Union of poultry producers, said that managers of poultry farms need to design some tools to attract workers. Raising wages is a sure bet, in her view. With an average monthly salary in a Russian industrial poultry farm amounting to 50,000 roubles (US$ 700) maximum, compared to 90,000 roubles (US$ 1,200) in food delivery, there is still ample room to attract people. At least in theory. A source in a local poultry company commented that in 2022 most companies in the Eurasia Union would have to raise wages by 20% in order to keep staff, especially on farms located close to big cities where there is some competition for workers. The source noted that wages had already gone up by 20% since the beginning of the pandemic.

In September of 2020, Russian poultry farmers asked the Agricultural Ministry to amend labour legislation by lowering payments on staff so that they could secure additional funds to raise salaries. At the same time, the Russian Labour Ministry announced plans to try and attract more immigrants to work in agriculture. The Ministry estimated that in 2022 the share of immigrants in the Russian poultry industry could be close to 50%. Before the Covid-19 pandemic, Russia hosted as many as 12 million labour migrants, primarily from Central Asia: Tajikistan, Turkmenistan, Kyrgyzstan and Uzbekistan. During the first lockdowns in May 2020, a significant proportion of them moved back home expecting to return within a few weeks. The following termination of the flight connection with Central Asia took them by surprise.

Prospects gloomy

These labour market problems may have been exposed by the Covid-19 pandemic but they are expected to last longer, which means poultry farmers must brace themselves for worsening conditions in the years to come. It is believed that the current crisis in Eastern Europe is associated with a what is termed a ‘demographic pit’. The Russian Academy of Science projected that the working age population in Russia would shrink by 7 million by 2030. This demographic pit is not confined just to Russia, as it is also seen in other former communist states: Bulgaria, Romania, Serbia and Ukraine. The working populations of Central and Eastern European countries — with the exception of Turkey — are expected to decrease significantly over the next 30 years, driven by low or negative net birth rates and outward migration, as shown by research conducted by the International Monetary Fund in 2019. Bulgaria, Poland, Latvia and Ukraine are likely to lose up to a third of their working-age population during that period.

Join 31,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the poultry sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht