BRICS expansion increases grip on poultry market

At their meeting in South Africa, the current 5 BRICS member countries decided to admit 6 more countries on 1 January 2024. BRICS+ includes Egypt, Argentina, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates and aims to create a political and economic counterweight to the West, which in 2021, also contributed 38.5% to the global production of chicken meat and 52% to the global production of shell eggs.

The planned enlargement of BRICS will increase the population of the grouping by 414.3 million, bringing it to 3.677 billion, which corresponds to 46% of the world’s population. Of this, China and India alone will account for 2.8 billion or 35.7%. As can be seen from Table 1, China will be the leading economic power, accounting for 17.8% of global added value alone. It has a share of 60.6% in the gross national product of BRICS+. All other member countries lag far behind. It may be assumed that China will decisively determine the further strategies of the alliance in the future.

There are major differences in terms of value added per capita and thus in purchasing power. Based on its extensive oil and gas reserves, the United Arab Emirates and Saudi Arabia occupy a leading position. The gap with the next 3 countries, which are still above the world average, is considerable. By comparison, the value added per capita in India and Ethiopia is very small. They expect to benefit from the merger in terms of economic development and trade relations.

Shares in poultry production

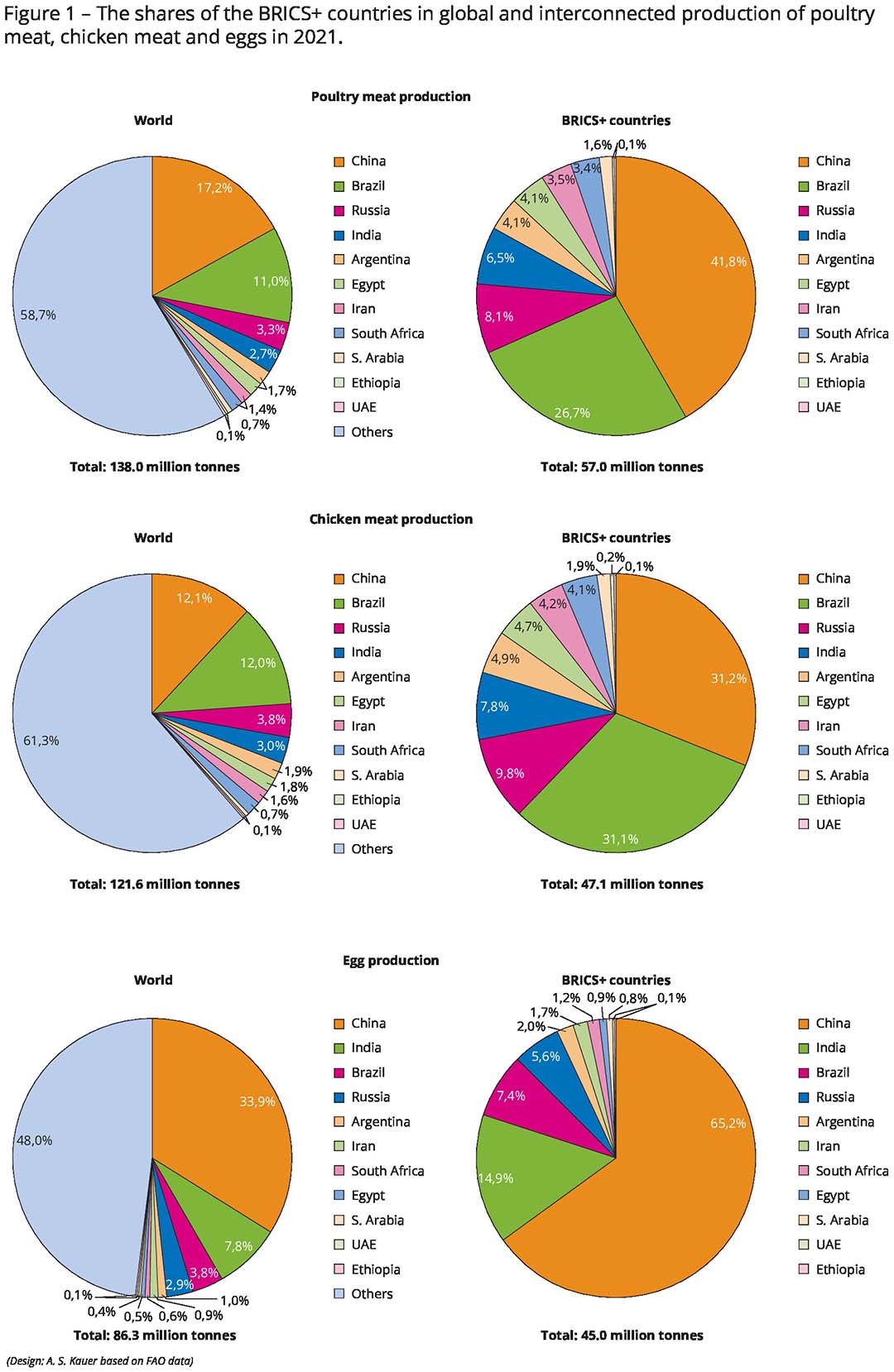

A comparison of the BRICS+ share in world production of poultry meat and eggs with that of the EU (27) and the US in 2021 shows the strong position of the group (Table 2). Breaking down the BRICS+ shares by country (Figure 1), the exceptional position of China and Brazil in poultry meat production becomes clear. Together, they accounted for 28.2% of world production in 2021, more than twice that of the EU (27) and 11.4% more than the US. These 2 accounted for 68.5% of BRICS+ total production volume. It should be emphasised that Saudi Arabia and the United Arab Emirates, which have a high demand for poultry meat, produce only small quantities domestically.

BRICS+ contributed 38.5% to the global production of chicken meat, the most important poultry product. Again, China and Brazil held the 2 leading positions. Together they accounted for 24.1% of world production, more than double the EU (27) and 7% more than the US. They accounted for 62.3% of total production in the group. All other countries lagged far behind. The role played by BRICS+ member countries in world trade for poultry meat is discussed below.

BRICS+ contributed 52% to the global production of shell eggs in 2021, with China alone accounting for 33.9%. Only India, Brazil and Russia had sizeable production volumes. The 3 countries together accounted for 14.5% of global production, almost double that of the US and the EU (27). Because shell eggs cannot be frozen, the volume traded is far below that of the US and the EU (27).

The BRICS+ countries also played a prominent role in the production of duck and goose meat. This is solely due to China’s large production volumes. Only small quantities were produced in the other member countries. For turkey meat the contribution to world production was much smaller with only Brazil achieving a considerable share of 20.5%. Little or no turkey meat was produced in the other countries, which is due to the low per capita consumption.

Large differences in shares of world trade in poultry meat and eggs

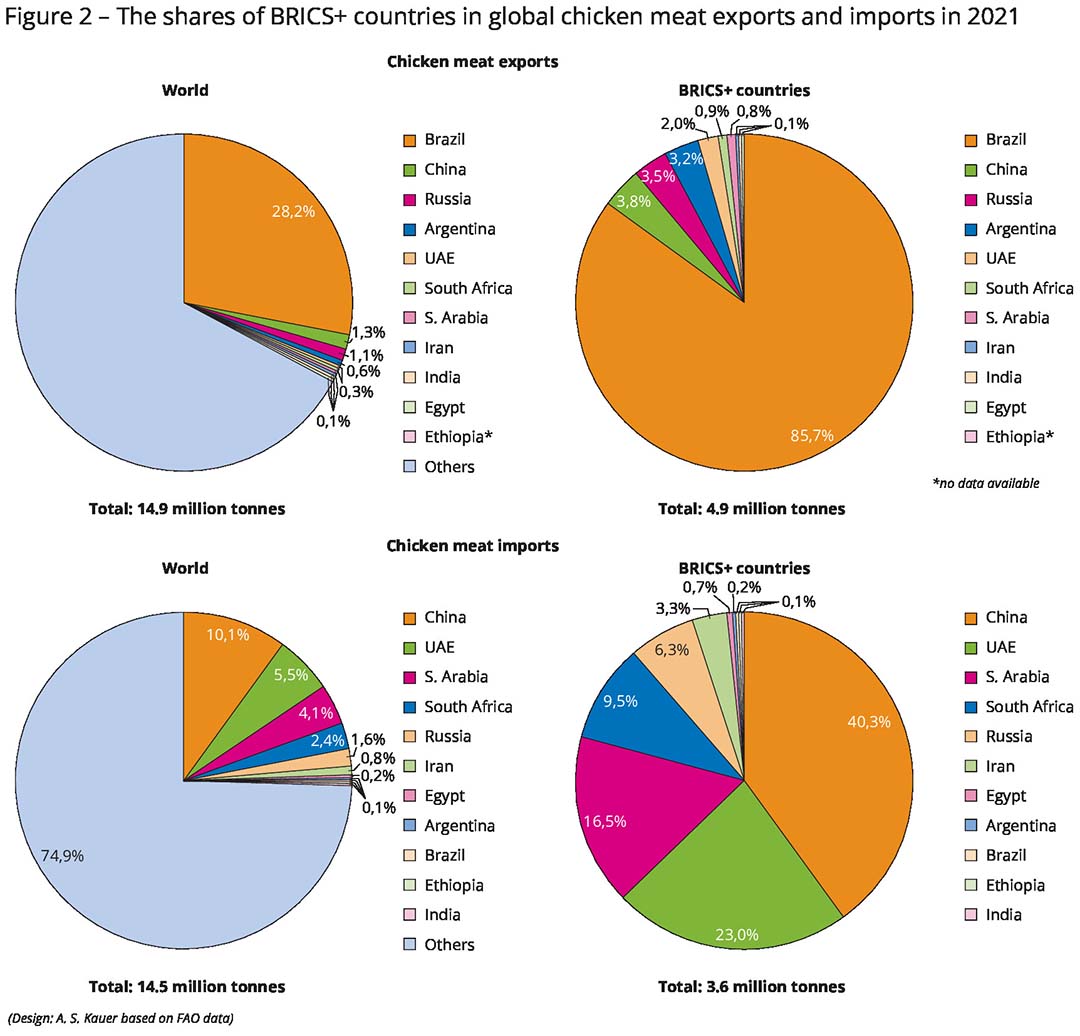

The shares of BRICS+ countries in the export and import of poultry meat and eggs in 2021 showed wide differences. The high share in poultry meat exports is mainly due to Brazil’s role in the chicken meat trade. As can be seen from Figure 2, it represented 28.2% of the world exports. The US, which ranked second in world trade of this meat type, was only slightly below the EU’s share (27). Shell eggs were mainly traded within the EU (27). Here, both the US and BRICS+ countries had almost equal shares. However, a detailed analysis would show that the trade flows differed significantly.

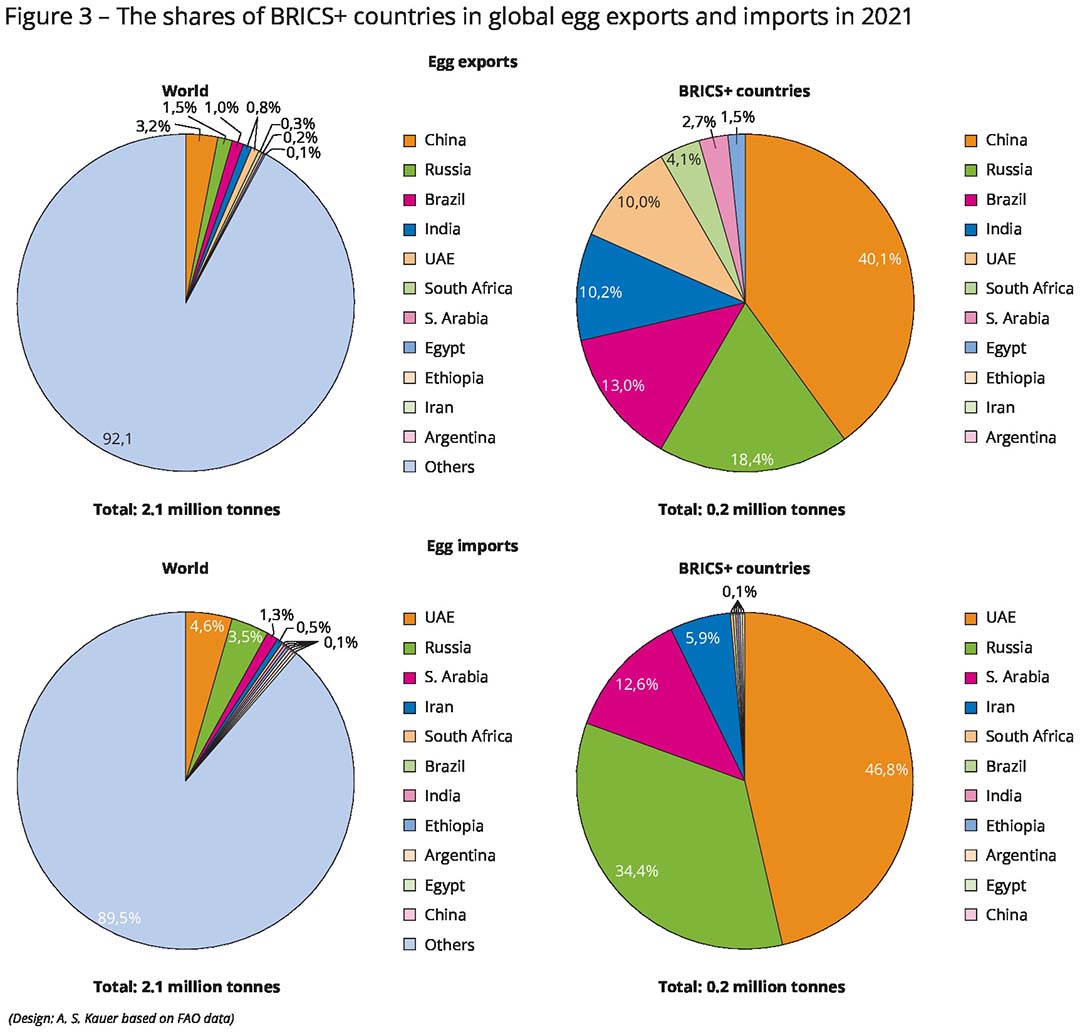

Chicken meat was mainly imported by China, the United Arab Emirates, Saudi Arabia, South Africa and Russia. Together they accounted for 24% of world imports. The volume of egg imports was low for the reasons already mentioned. A total of only about 211,000 tonnes were imported by the BRICS+ countries, of which 93.8% was accounted for by the United Arab Emirates, Russia and Saudi Arabia. All other countries, apart from Iran, imported only very small quantities, in some cases less than 1,000 tonnes (Figure 3).

Chicken meat was mainly imported by China, the United Arab Emirates, Saudi Arabia, South Africa and Russia. Together they accounted for 24% of world imports. The volume of egg imports was low for the reasons already mentioned. A total of only about 211,000 tonnes were imported by the BRICS+ countries, of which 93.8% was accounted for by the United Arab Emirates, Russia and Saudi Arabia. All other countries, apart from Iran, imported only very small quantities, in some cases less than 1,000 tonnes (Figure 3).

Outlook

Analysis could suggest that the expansion of BRICS will lead to the group holding an even stronger position in the world poultry economy. The BRICS+ countries accounted for more than half of the world’s egg production, over 41% of poultry meat and 38.5% of chicken meat in 2021. The degree of regional concentration within the grouping was very high. China and Brazil dominated in poultry meat, and China and India in eggs.

The BRICS+ countries accounted for almost one-third of global trade in chicken meat in 2021, but this was mainly due to Brazil’s high export volumes. The shares of the other countries were comparatively small, with only China, Russia and Argentina each accounting for more than 1% of global exports. The share of the BRICS+ countries in global chicken meat imports was much lower at 25.1%. China held the top position here, followed by Saudi Arabia, the United Arab Emirates, South Africa, Russia and Iran.

Because shell eggs cannot be frozen, comparatively small quantities were traded. The BRICS+ countries held only an 8% share in global exports and 10% for imports. China, Russia and Brazil led in exports, the United Arab Emirates, Russia and Saudi Arabia in imports. The countries on the Arabian Peninsula were attractive markets for both chicken meat and shell eggs. Regional concentration was also very high for imports of chicken meat and shell eggs. The United Arab Emirates and China accounted for 63.3% of the group’s chicken meat imports; the United Arab Emirates and Russia for 81.2% in shell egg imports.

Because shell eggs cannot be frozen, comparatively small quantities were traded. The BRICS+ countries held only an 8% share in global exports and 10% for imports. China, Russia and Brazil led in exports, the United Arab Emirates, Russia and Saudi Arabia in imports. The countries on the Arabian Peninsula were attractive markets for both chicken meat and shell eggs. Regional concentration was also very high for imports of chicken meat and shell eggs. The United Arab Emirates and China accounted for 63.3% of the group’s chicken meat imports; the United Arab Emirates and Russia for 81.2% in shell egg imports.

In their long-term forecasts, the US Department of Agriculture and the OECD-FAO assume that both egg and poultry meat production will show high absolute and relative growth rates in the coming decade. Development is likely to be particularly dynamic in emerging and developing countries that are forecast to account for nearly 81% of the increase in the production of shell eggs and 79% of that of poultry meat. Of the projected increase in egg production from 92.5 million metric tonnes (mmt) to 103 mmt, only about 2 mmt are expected to come from industrialised nations and 8.5 mmt from emerging and developing countries. In Asia, production will increase by 7.3 mmt. China and India together will account for 4.5 mmt.

World production of poultry meat is expected to increase by 19.7 mmt; in Asia alone by 10 mmt and in Latin America by 4.5 mmt. Production in the industrialised countries is expected to increase by 4 mmt, and by 15.7 mmt in emerging and developing countries.

The OECD-FAO Agricultural Outlook expects world trade in poultry meat to increase from 15.7 mmt, the average in 2020-2022, to 16.5 mmt, or by 5.1%. While only a small change is expected in the trade volume of industrialised countries, an increase from 8.2 mmt to 9 mmt is forecast for developing countries. Latin America and Asia will account for roughly equal shares.

Poultry meat imports are predicted to increase by nearly 1 mmt. Of this, developing countries will account for 720,000 mt. Imports from African countries will increase by about 500,000 mt, those from Latin American countries by 200,000 mt. No projections have been provided for the development of world egg trade.

Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht